OPERATING EXPENSES VS CAPITAL EXPENSES SOFTWARE

subscription fees for off-the-shelf software.for example, site maintenance and content updates.for example, protective covers and earphones.small-value mobile phone and tablet accessories.income tax obligations, employer super contributions, or late payment or lodgment of tax.producing assessable income or purchasing income-producing assets.insurance premiums, including accident or disability, fire, burglary, professional indemnity, public risk, motor vehicle, loss of profits insurance, or workers compensation.penalties and fines imposed by statutory bodies as a result of breaches of an Australian law are not deductible (for example, late payment fees are usually penalties).annual fees charged by statutory bodies (for example, ASIC).tender costs, even if the tender is unsuccessful.

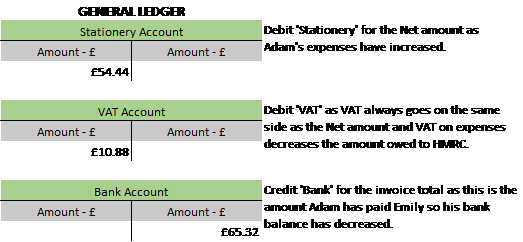

legal expenses, such as those incurred defending future earnings, borrowing money, discharging a mortgage or obtaining tax advice.purchases of trading stock, including delivery charges.Operating expenses that are common in business include: You can only claim the business portion of these expenses if they relate to both business and private use, for example mobile phone calls. Ensure you keep accurate and complete records of these expenses as they occur. You can generally claim a tax deduction for most operating expenses associated with running your business in the same income year you incur them. These expenses are sometimes called working or revenue expenses. Examples include office stationery, renting premises and purchase of trading stock. Operating expenses are the expenses you have paid for (incurred), or have to pay for (incur), in the everyday running of your business. Operating expenses from employing people.Other expenses (similar to those claimed by employees).Operating expenses for the everyday running of businesses are generally deductible in the year you pay for them. Claiming a tax deduction for other operating expenses

0 kommentar(er)

0 kommentar(er)